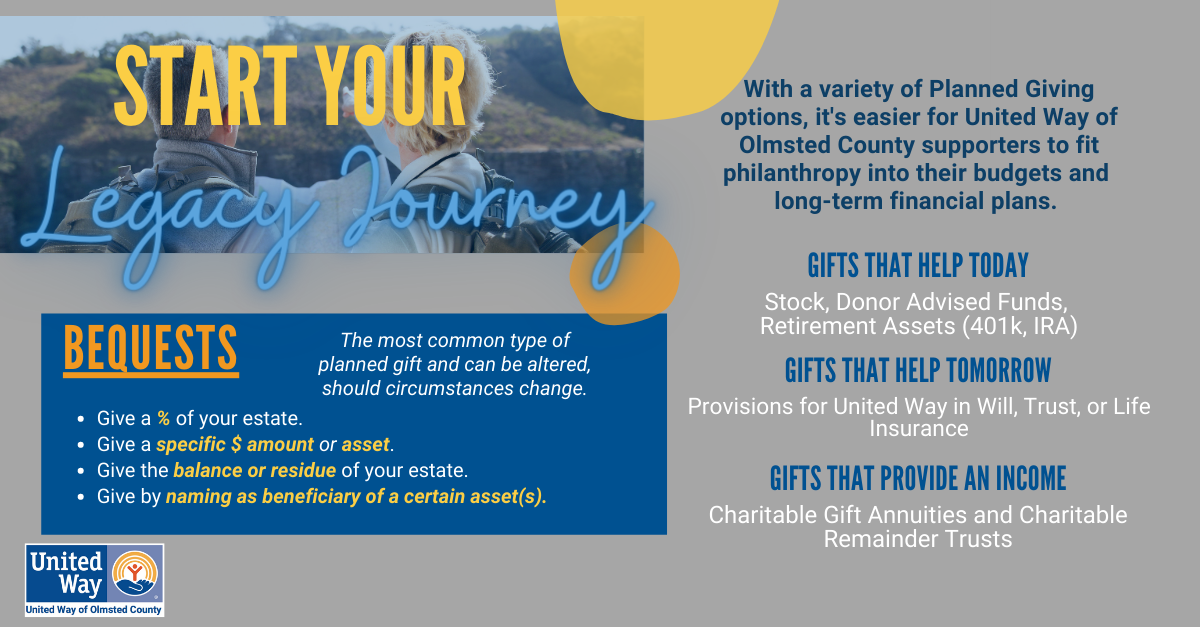

By making a planned gift to UWOC, you can make a significant gift and also earn financial and tax benefits. What are the tax benefits of planned gifts? Read our blog to find out. And if you've included us in your estate plans, please let us know so we can properly thank your generosity.

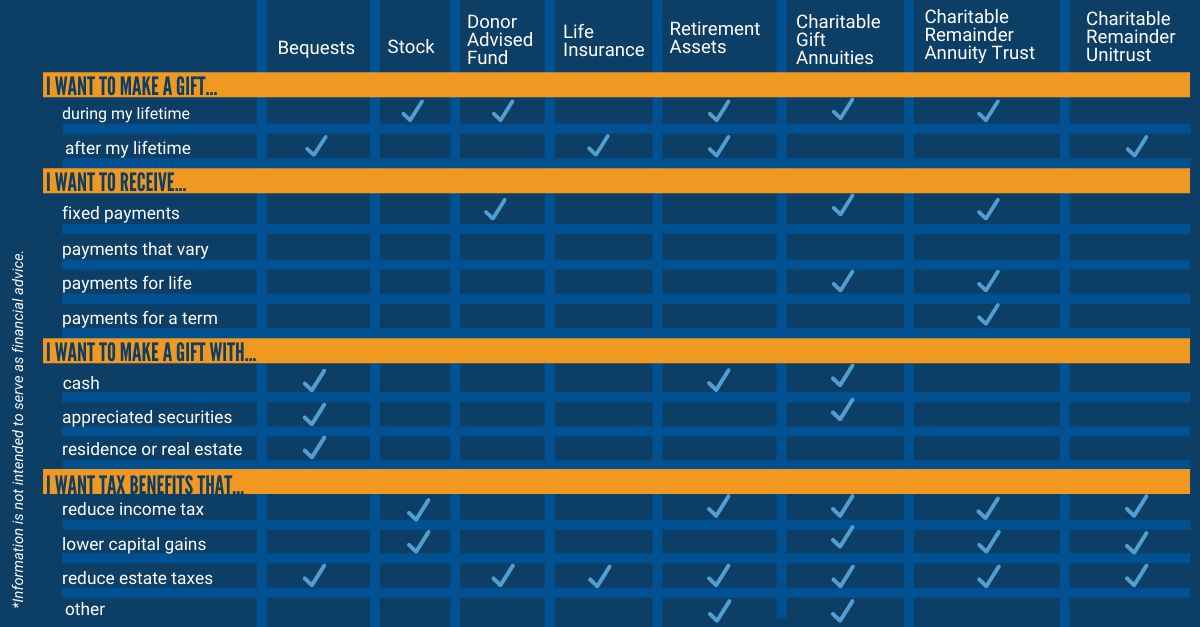

* Contribute appreciated assets, like stock or real estate, receive a charitable deduction for the full market value of the asset, and pay no capital gains tax on the transfer.

*Establish a life-income gift and earn a tax deduction for the full, fair market value of the assets contributed, minus the present value of the income interest retained. If the gift is funded with appreciated property, bypass payment on the upfront capital gains tax on the transfer.

*Exemptions for estate tax can be received through bequest or beneficiary designations in a life insurance or retirement account, when the gift becomes payable to charity upon passing.

To view the complete Planned Giving brochure, click here.